The US Senate approved a massive stimulus bill; House approval is expected Friday, March 27.

A veteran labor-law attorney from Venable presented at OAAA’s webinar on March 24 (regarding state executive orders). Here, Venable provides a clearly worded analysis of the small business section of the federal stimulus legislation.

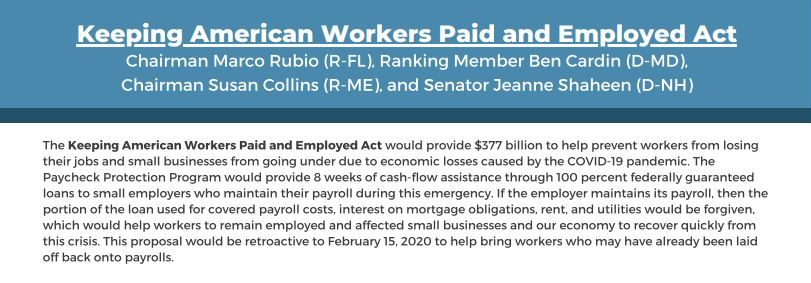

As Congress considers stimulus legislation, here is information to help better understand the prospect of Small Business Administration (SBA) loan relief:

Loans are generally available to small businesses that meet certain SBA size standards, which vary by industry. These standards are determined by revenue (gross receipts) and/or number of employees thresholds for the business and its affiliates. The SBA website offers a size standards tool to assist in determining whether a business is small. This is the single most important eligibility standard.

For information on how to apply, the SBA has set up a new webpage with information and an application.

Here is a summary of the Small Business provisions included in the latest draft of the CARES Act as prepared by the Senate working group.

Published: March 26, 2020