Place Exchange recently released its semi-annual Programmatic OOH Trends Report,

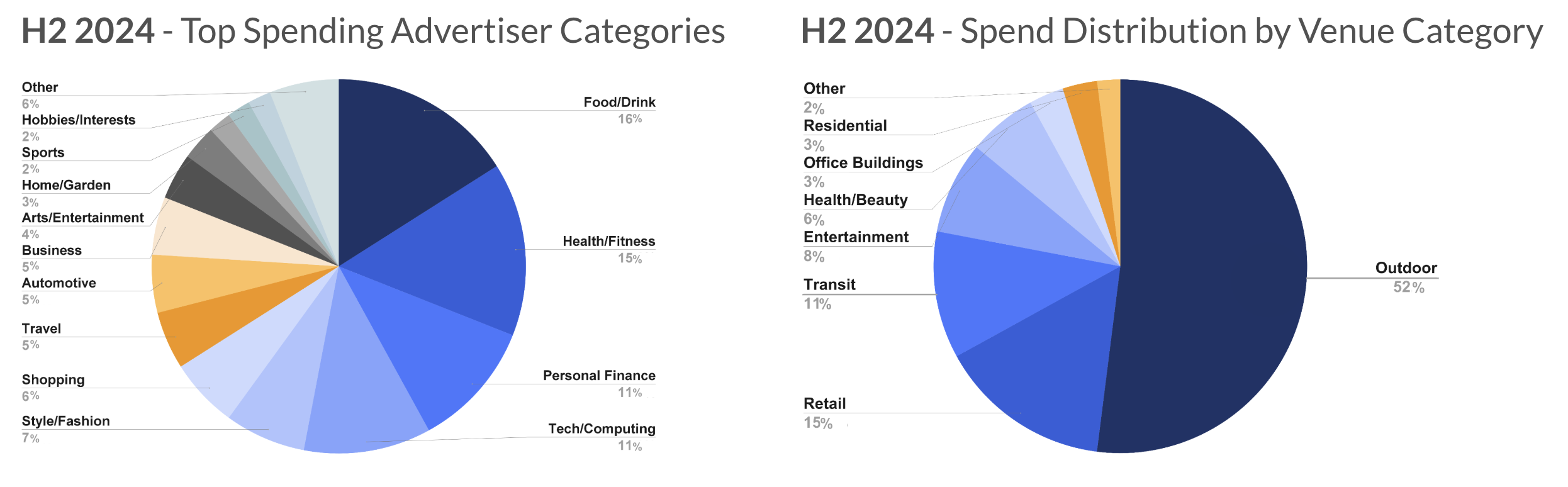

Programmatic OOH continues to attract advertisers across a wide range of categories. On the Place Exchange platform, Food/Drink, Health/Fitness, and Personal Finance led the way, collectively accounting for 42% of H2 2024 spend, followed by the Tech/Computing, Style/Fashion, Shopping, Travel, and Automotive categories.

Outdoor (including billboards and street furniture) remained the largest venue category, with 52% of spend, followed by retail with 15% of spend, Transit with 11%, and Entertainment venues with 8%. We foresee the retail category in particular growing rapidly, as advertisers increasingly start to think of OOH as an extension of their retail media strategy.

The growing availability of programmatic-enabled screens is creating new opportunities for brands to engage consumers across a more diverse OOH ecosystem. Between H1 and H2 2024, the number of programmatic screens available via Place Exchange grew by 25%, driven primarily by new inventory in entertainment, retail, transit, and healthcare venues.

Programmatic OOH CPMs remained strong, averaging $7.62 in H2 2024 as compared with $7.16 in H1 2024. Point of Care, Transit, and Entertainment CPMs saw significant increases, while Retail and Healthy/Beauty venues also saw higher CPMs. The most notable decline in CPM was for the Education category.

Private deals, accounting for 95% of spend on the Place Exchange platform, remained strongly preferred over open auction buying, as they offer highly flexible campaign delivery, transparency around media pricing, and certainty around inventory quality – all factors that are growing in importance to buyers. Notably, Programmatic Guaranteed (PG) deals, while still a small percentage of overall transactions, saw a significant relative increase in H2 2024, doubling from 1% to 2% of total spend. PG deals allow buyers to access premium OOH inventory on a guaranteed basis while still enjoying the many benefits of executing programmatically via their DSP of choice.

As more brands recognize the unique value of programmatic OOH—whether for upper-funnel brand-building or performance-driven campaigns—the number of unique advertisers leveraging programmatic OOH continues to grow. On Place Exchange’s platform, that number grew by 31% between H1 and H2 2024, demonstrating the expanding appeal of programmatic OOH.

Download the full report here.

Published: February 20, 2025