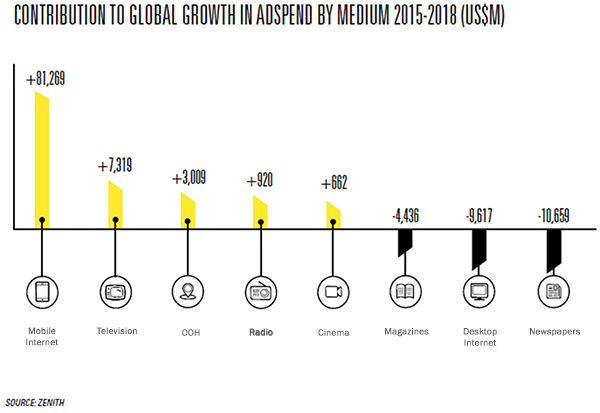

“Thanks to favorable lifestyle evolutions, innovation and investment from media owners and public authorities, global OOH has been the only ‘traditional’ media category to show consistent growth in the last ten years, while TV and radio have stagnated and print sales have declined.”

– Vincent Létang, EVP, GlobalMarket Intelligence at MAGNA

Top Global Advertising Stories 2017

Media owners’ net advertising sales will grow by +3.7 percent to $505 billion in 2017, which is a noticeable drop compared from the 2016 growth rate of +5.9 percent. The lack of cyclical events in 2017 (global sports events or US elections), and the US market itself are contributing the bulk of the global slowdown.

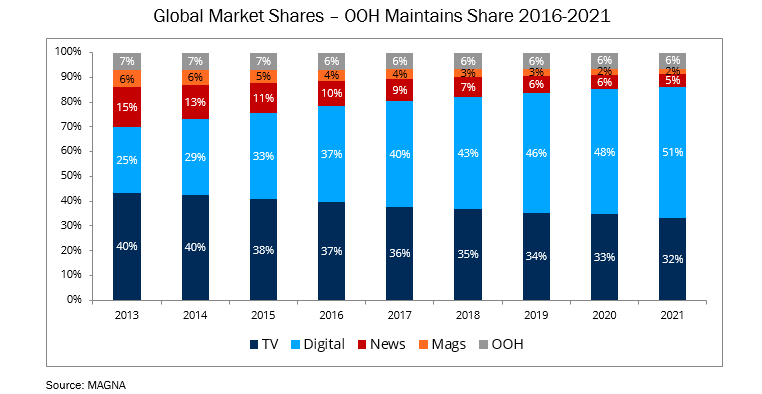

- Digital media has now surpassed linear television to become the No. 1 category in advertising. Within digital, the majority of advertising sales (54 percent) is now generated by impressions and clicks on mobile devices.

- Television ad sales will be down (-1 percent) for the first time since 2009.

- US advertising sales will grow by +1.6 percent to $185 billion following a record performance of +7.7 percent last year. The lack of global sports events and elections in an odd-numbered year is responsible for most of the slowdown. Excluding those cyclical events, 2017 growth would be a robust +3.4 percent, compared to a six-year-high +5.9 percent last year.

Key Facts About Global OOH:

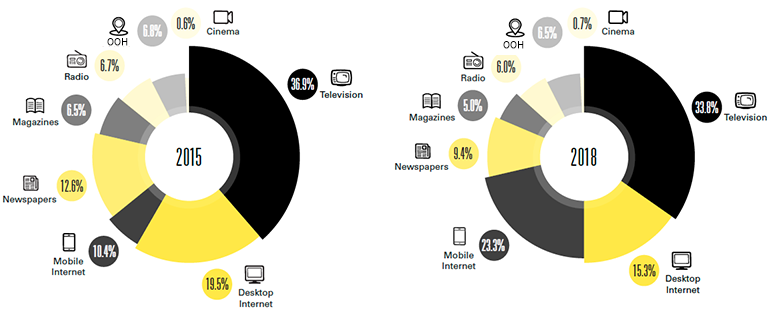

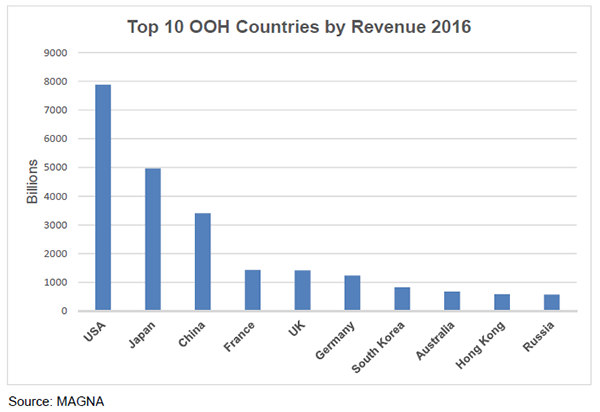

- OOH advertising is a $28 billion market, controlling a market share of approximately 6 percent globally.

- The market share of OOH versus all other media categories (including online) has been stable in the last five years, but it has actually increased from 8 to 10 percent of traditional media ad spend (TV, print, radio, OOH).

- It is the only traditional medium that has been growing ad sales consistently over the last 10 years and this is predicted to continue.

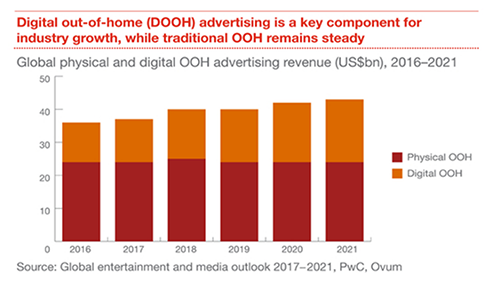

- Revenue will grow by 4 percent per year in the next five years to reach $33 billion by 2021.

- Investment in digital OOH inventory is the main driver behind OOH resilience, attractiveness, and performance in recent years. Digital inventory has increased by 30 percent in the last two years to reach approximately 300,000 units globally (excluding place-based).

- Although digital is only 5 percent of the global inventory, it already accounts for 14 percent of advertising revenues. In fact, DOOH already accounts for 22 percent of revenue in some markets like the UK and the global share is predicted to grow to 24 percent by 2021.

- Large format roadside billboards remain the biggest OOH segment in most markets, but its shares of inventory and revenue are gradually declining as conversions to digital billboard platforms continue. The transit and street furniture segments attract more investment from media owners and more interest from advertisers.

Reaching Today’s Fragmented Consumer Audiences is OOH’s Strength

- OOH media reach at least half of the relevant consumer audience in most markets, placing it among TV and radio as a true mass medium.

- While traditional billboards’ share of inventory in some countries is plateauing, in the US they are still the most noticed and most engaged-with type of OOH ad.

- With digital inventory still evolving and growing in the US, other traditional formats like signage, posters, and public buses follow behind billboards as the most noticed.

- Place-based video has been growing rapidly in the US, with nearly half of consumers noticing these locations and audiences on the rise in venues like elevators, gyms, and hotels.

- Measurement approaches for OOH audiences vary across markets, but Germany, the US, and the UK are among the markets seeking to improve by including electronic location data and eye-tracking techniques.

Share of Global Ad Spend by Medium (%)

OOH’s Competitive Advantages

OOH advertising cannot be skipped or blocked. Today’s busy consumers, especially the younger generations, are experts at advertising avoidance by choosing ad-free, paid media, or blocking ad insertions on free websites. OOH is much less threatened by this phenomenon than other traditional media.

OOH is expanding to brand new environments. OOH digital screens penetrate niche environments to engage the young urban population that is hard to reach through traditional media: offices, taxis, gyms, bars, retail and more. Digital place-based OOH provides important targeting capabilities and programmatic opportunities.

OOH can address branding campaigns as well as lower path to purchase funnel activation. OOH’s ubiquitous nature provides an innate ability to target consumers at or near the point-of-sale. Connected digital screens, usage of smartphone data and marketing data allow marketers to target specific day parts, target groups and location with increasing relevance. Benchmarketing’s recent OOH ROI Study provides greater insights.

What Kind of Messaging do Consumers Really Want?

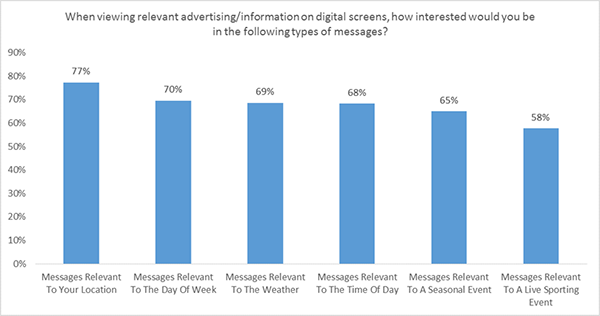

Based on the views of over 60,000 consumers from nine countries (the UK, France, Germany, Italy, Spain, Japan, Australia, the USA, and Singapore), Posterscope’s OCS study reveals a unanimous trend in the dynamic content that consumers engage with most when it comes to DOOH – Location. On average 60-70 percent of global consumers engage with contextual DOOH messages relating to the weather, time of day, day of week, seasonal events and live sports updates, but location is the dynamic content type most favored. Almost eight in 10 global consumers state that they are interested in location-based messages on DOOH.

New Value Drivers for DOOH Across the Globe

- As DOOH evolves, so will its ability to deliver creative that is contextual and supports brand objectives, using weather, social, transit, and news data.

- DOOH is being used to augment social campaigns, either through integration or content creation (conversations, AR stunts, interactive events, etc.)

- Programmatic DOOH technologies are being used to buy and optimize campaigns on connected DOOH units, helping brands to deliver the right ad in the right place at the right time using consumer and mobile location data.

- Leveraging smartphones (data, activity tracking, and interactivity) specifically to maximize the efficacy of a DOOH campaign is not just recommended, but crucial for value maximization.

- The future of DOOH will rely on improved physical measurement such as live location-based data, as well as better attribution tools like beacons or recognition software

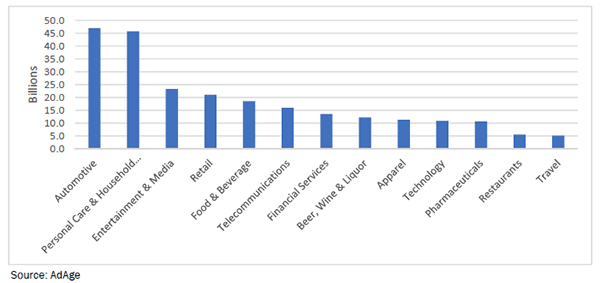

World’s Top Advertising Categories

Sixteen of the World’s 100 Largest Advertisers are in the automotive category–15 automakers and tire maker Bridgestone–with total worldwide ad spending of $47 billion in 2015. Spending by personal care and household products marketers was close behind at $45.7 billion.

Download the PDF

Download the PDF

Published: August 14, 2017

Media owners’ net advertising sales will grow by +3.7 percent to $505 billion in 2017, which is a noticeable drop compared from the 2016 growth rate of +5.9 percent. The lack of cyclical events in 2017 (global sports events or US elections), and the US market itself are contributing the bulk of the global slowdown.

Media owners’ net advertising sales will grow by +3.7 percent to $505 billion in 2017, which is a noticeable drop compared from the 2016 growth rate of +5.9 percent. The lack of cyclical events in 2017 (global sports events or US elections), and the US market itself are contributing the bulk of the global slowdown.